Top Stories

Ethereum Hits Five-Month High as Public Companies Build ETH Treasuries

Ethereum surged to $3,155, its highest price since February, following a wave of ETH purchases by public companies shifting toward crypto treasuries. SharpLink Gaming acquired $225 million in ETH, bringing its total holdings to 280,000 ETH, while BitMine Immersion Technologies and Bit Digital have also amassed over $500 million and $316 million in Ethereum, respectively. These moves have driven triple-digit stock gains for the companies and reflect a growing trend of viewing ETH as a programmable, yield-bearing store of value.

Bitcoin Becomes 5th Largest Asset, Surpassing Amazon at $2.41T

Bitcoin has overtaken Amazon to become the world’s fifth-largest asset by market cap, driven by over $3.7B in weekly ETF inflows, pro-crypto U.S. policy momentum, and improving liquidity. With upcoming legislation and potential Fed rate cuts on the horizon, analysts see room for further upside -- though fragile retail sentiment and regulatory risks still loom. See more: OG bitcoin whale moves billions of dollars in BTC to Galaxy Digital: onchain analysts

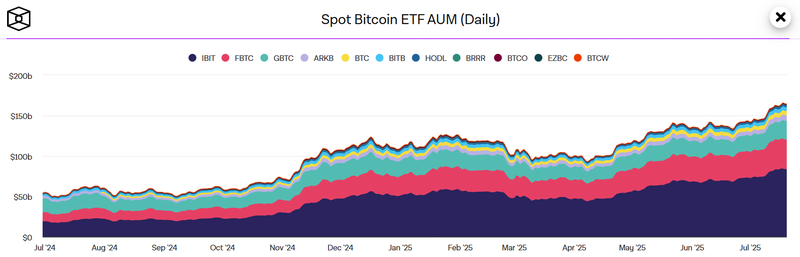

Bitcoin Hits ATH as ETFs Soar, Volumes Lag, and Retail Reawakens

Bitcoin closed above $119K this week -- a fresh all-time high -- driven by record ETF accumulation (AUM now ~$160B) and futures open interest (OI at $54.6B), despite spot and futures volumes falling sharply from early 2025 levels. The divergence highlights structurally bullish flows atop thinning liquidity, as 7DMA spot volumes near yearly lows and futures volume hits a 9-month low. Meanwhile, retail sentiment is stirring: Coinbase's App Store ranking rebounded from 436 to 162 in under a month, historically a signal of incoming FOMO. If the trend persists, this rally could climax with multiple crypto apps storming the App Store charts -- a fresh twist on an old cycle indicator.

Source: The Block

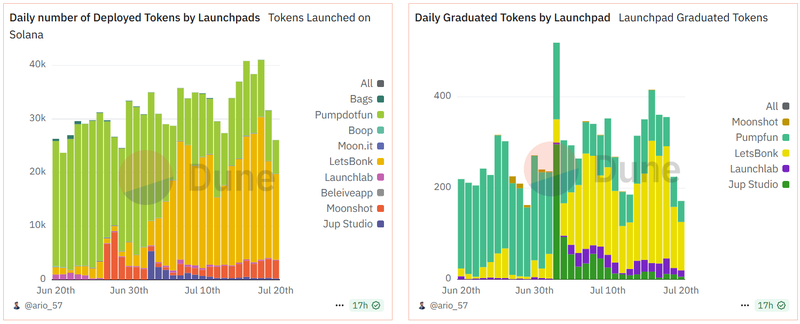

Things Are Getting Hot Close To The SOL

Solana's ETF debut on July 2nd marked a historic step forward in crypto ETF innovation, with REX-Osprey’s product pulling $69.7M in net inflows and $160M+ in volume thanks in part to integrated staking -- a yield-generating feature Bitcoin ETFs can’t match. Meanwhile, Solana’s retail scene exploded as LetsBonk launchpad activity skyrocketed from 882 tokens/day on June 29 to a record 22.3K on July 9, fueled by memecoin $USELESS’s meteoric rise from $6M to $320M market cap. Daily fees on LetsBonk soared from $35K to $1.18M, flipping market share from pump.fun (77% → 25%) to LetsBonk (3.5% → 66%). The combo of institutional validation via ETFs and wild memecoin speculation underscores Solana’s uniquely volatile growth engine.

Source: Dune

Coinbase Launches Base App, a Social-AI-Crypto “Everything App”

Coinbase has rebranded its wallet as the Base app, positioning it as a comprehensive onchain platform that merges crypto wallets, social feeds, creator monetization, AI tools, and messaging into one seamless user experience. Announced at a packed event in Los Angeles, the app features smart wallet integration, Farcaster-powered social networking, encrypted group chats with in-chat crypto payments, and monetizable posts. CEO Brian Armstrong described the launch as Coinbase’s “Netscape moment,” aiming to onboard a billion users by assembling the open-source “Lego pieces” of the onchain economy into one user-friendly app.

Regulation

Trump Signs GENIUS Act, First Major U.S. Crypto Law

President Trump has signed the GENIUS Act into law, establishing the first federal framework for stablecoins. The bill mandates full dollar backing, annual audits for issuers over $50B in market cap, and new rules for foreign-backed tokens. At the signing, Trump called it a “giant step” for U.S. crypto leadership and mocked past enforcement actions under Biden. The move marks a turning point in regulatory clarity for stablecoin issuers and investors.

Grayscale Eyes Public Listing Amid IPO Boom

Grayscale has confidentially filed a draft S-1 registration with the SEC, signaling potential plans to go public. While details on share count and pricing remain undisclosed, the move aligns with a broader IPO resurgence across sectors and crypto firms. The asset manager joins peers like Circle, Gemini, and OKX exploring listings, as crypto markets rally and investor appetite returns.

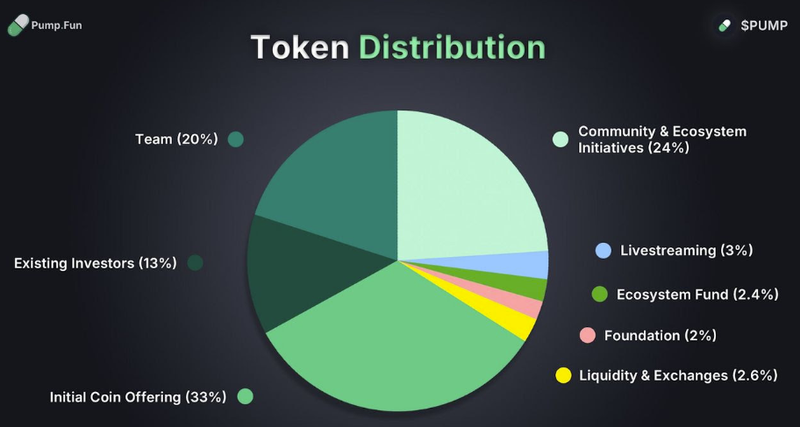

Pump.fun Raises $1.32B in $PUMP ICO, Shifts Focus to Social Token Infrastructure

Pump.fun raised $600 million in its public $PUMP ICO and another $720 million privately, totaling $1.32 billion at a fully diluted valuation of $4 billion. The token, priced at $0.004, saw 33% of its 1 trillion supply sold, and offers utility by redistributing 25% of platform revenue to holders. Since listing, $PUMP is up over 40 percent, and the project is now positioning itself as a social finance platform where users build influence through token market caps rather than follower counts, with features like token feeds, profiles, chats, and livestreams shaping a new form of on-chain engagement.

Source: PumpDotFun

Strategy’s $72B Bitcoin Held Across Multiple Secret Custodians, Not Just Coinbase

While Coinbase has confirmed it is one of Strategy’s Bitcoin custodians, the $72 billion treasure trove is actually distributed across multiple firms, with Strategy declining to name them publicly due to security concerns. SEC filings confirm all custodians are NYDFS-regulated, narrowing the list to nine, including BitGo, Gemini, Fidelity, and NYDIG. Blockchain analytics firm Arkham believes Fidelity alone holds 70,000 BTC for Strategy, and speculation continues amid renewed scrutiny following Michael Saylor’s resistance to disclosing proof-of-reserves.

Other Domestic Regulation Updates

- Cantor Fitzgerald SPAC to close multi-billion-dollar bitcoin deal with Adam Back

- Biotech firm agrees $888M merger to become Hyperliquid Strategies, launch HYPE treasury

- Polymarket Investigations Dropped by Justice Department, CFTC

- Trump Pushes House GOP to Revive Vote on Crypto Bills

Other International Regulation Updates

- JPMorgan: Non-U.S. regulators appear to favor tokenized bank deposits over stablecoins

- Tether's CEO Says USDT Is Coming to America—And Circle’s CEO Isn’t Afraid

Pain & Gain

Pain

- Rep. Waters says crypto bills could 'open floodgates' to fraud, slams Trump's ties to industry

- Dormant Satoshi-Era Bitcoin Whale Moves $4 Billion—But It May Not Be a Sell-Off Indicator

Gain

- NFTs Reignite as Bitcoin Hits ATH and Traders Seek High-Beta Plays

- Coinbase Unveils 'Base App' as All-in-One Web3 Super App

- Crypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills

Important Legal Notices

This reflects the views MJL Capital LLC (“MJL”), but it should in no way be construed to represent financial or investment advice. Nothing in this correspondence is intended to constitute or form part of, and should not be construed as, an issue for sale or subscription of, or solicitation of any offer or invitation to subscribe for, underwrite, or otherwise acquire or dispose of any security, including any interest in any private investment fund managed by MJL. Any such offer may only be made pursuant to a formal confidential private placement memorandum of any such fund, which may be furnished to potential investors upon request and which will contain important information to be considered in connection with any such investment, including risk factors associated with making any investment in any such fund. Further, nothing in this correspondence is, or is intended to be treated as, investment or tax advice. Each recipient should consult their own legal, tax and other professional advisors in connection with investment decisions.

Domenic Salvo is a Managing Partner at MJL Capital, helping lead Portfolio Research and Investor Relations.